The GameStop (GME) stock saga is a landmark event in the history of the stock market, showcasing the power of retail investors and the impact of social media on trading dynamics. This comprehensive analysis explores the multifaceted aspects of the GME stock phenomenon, highlighting insights from FintechZoom and other sources to provide a detailed understanding of its origins, impact, and future implications.

What is FintechZoom GME Stock?

“FintechZoom GME Stock” articles focus on providing comprehensive analysis, updates, and forecasts for GameStop (GME) stock. FintechZoom offers insights into market trends, stock performance, and volatility, helping investors make informed decisions. The platform combines financial data and news to predict stock movements and assess investment risks and opportunities. These resources aim to guide investors on whether GME stock is a worthwhile investment, considering its historical volatility and market dynamics.

The Role of FintechZoom

FintechZoom has been at the forefront of providing insights and analysis on the GME stock saga. The platform has highlighted several key factors influencing GME’s performance:

Market Dynamics

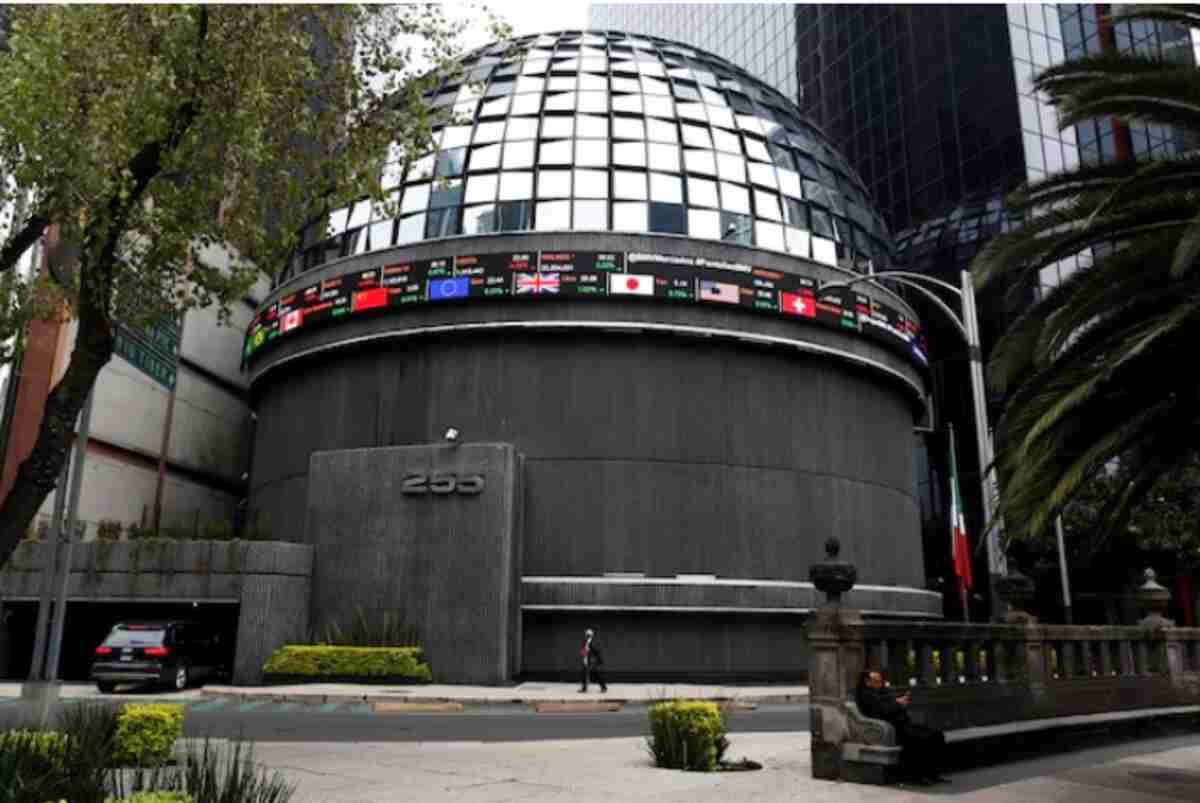

FintechZoom detailed the mechanics of the short squeeze and the subsequent volatility in GME’s stock price. The platform analyzed the roles of retail investors, hedge funds, and trading platforms like Robinhood, which temporarily restricted trading in GME, sparking further controversy.

Regulatory Response

The GME event attracted significant attention from regulators, with investigations into potential market manipulation and the practices of brokerage firms. FintechZoom provided updates on regulatory actions and the implications for future market regulation.

Technological Impact

The GME surge underscored the growing influence of technology in trading. FintechZoom explored how social media platforms, online forums, and trading apps have democratized investing, enabling retail investors to coordinate and execute complex trading strategies.

Impact on the Financial Industry

Empowerment of Retail Investors

Empowerment of Retail Investors

The GME event demonstrated the power of retail investors to influence stock prices and challenge institutional investors. This shift has led to increased recognition of the role of retail investors in the market, with more tools and platforms catering to their needs.

Increased Market Volatility

The influence of social media and online communities has introduced new sources of market volatility. Stocks can now experience rapid price swings based on viral trends and collective investor actions, posing challenges for market stability and regulation.

Scrutiny of Short Selling

The GME saga brought short selling into the spotlight, with debates over its ethical implications and impact on companies. There have been calls for greater transparency and regulation of short-selling activities to prevent potential market abuses.

Evolution of Trading Platforms

The role of trading platforms like Robinhood, which restricted trading in GME during the surge, has sparked debates over the accessibility and transparency of these platforms. There are ongoing discussions about the need for reforms to ensure fair and equitable trading practices.

Insights from FintechZoom and Other Sources

Market Analysis

Market Analysis

FintechZoom and other platforms have provided detailed analyses of GME’s market performance. According to Intercool Studio, the volatility of GME stock has created both opportunities and risks for investors. The stock’s performance is heavily influenced by market sentiment, which can be unpredictable and driven by social media trends.

Regulatory Developments

ODF Alliance highlighted the regulatory response to the GME saga, noting investigations by the SEC and other authorities into potential market manipulation. The scrutiny has led to discussions about the need for new regulations to address the challenges posed by social media-driven trading.

Technological Impact

TechQiah explored the role of technology in the GME phenomenon, emphasizing how trading software and social media platforms have democratized investing. The platform noted that this democratization has both positive and negative implications, enabling greater participation in the market while also introducing new risks.

Social and Cultural Implications

TechyInsider delved into the social and cultural dimensions of the GME saga, highlighting how the event reflected broader societal trends such as distrust of financial institutions and the rise of online communities. The platform also noted the cultural significance of the “diamond hands” meme, symbolizing investor resilience and commitment.

Future Outlook for GME Stock

The future of GME stock remains uncertain, with several factors influencing its trajectory:

Company Fundamentals

GameStop’s efforts to pivot its business model toward e-commerce and digital gaming will be crucial for its long-term viability. The company’s success in executing this strategy will significantly impact its stock performance.

Market Sentiment

The influence of retail investors and social media on GME’s stock price is likely to continue, making the stock subject to volatile price swings. Investors should be prepared for potential fluctuations and stay informed about market trends.

Regulatory Changes

Ongoing regulatory developments will shape the future landscape of trading. New regulations aimed at increasing transparency and protecting investors could impact how GME and similar stocks are traded.

Technological Advancements

Advances in trading technology and the increasing role of artificial intelligence and machine learning in market analysis could further transform the trading environment, providing new opportunities and challenges for investors.

Conclusion

The GameStop (GME) stock saga is a defining moment in the history of the stock market, highlighting the power of retail investors, the influence of social media, and the importance of technological innovation. FintechZoom’s comprehensive coverage has provided valuable insights into the complexities of the GME phenomenon, helping investors navigate this unprecedented event.

Empowerment of Retail Investors

Empowerment of Retail Investors Market Analysis

Market Analysis